Our May 2023 extension column is by Minnesota Sea Grant Fisheries Specialist Don Schreiner, pictured above on the left. Don and volunteer Nick Horton were recruiting fairgoers to participate in MNSG's consumer food-fish survey at the 2022 Minnesota State Fair.

Image credit: M. Thoms/MNSG

As I was out on the sidewalk, holding my sign trying to entice folks to enter the Driven to Discover building at the 2022 Minnesota State Fair and take our Minnesota Sea Grant (MNSG) consumer food-fish survey, I wondered, what are the chances that there will ever be a barn to showcase farmed fish at the Minnesota State Fair? For more than 160 years at the Minnesota State Fair, which officially began in 1859, there has been a barn or a portion of a barn dedicated to showcasing the best in breed of each type of livestock. In Minnesota, traditional livestock includes cattle, horses, hogs, sheep, rabbits and poultry. Never has there been a barn that holds farmed fish, although the Minnesota Department of Natural Resources has a very popular pond that displays wild fish.

Why did we go to the state fair?

We wanted to learn about fairgoers' knowledge, understanding, and perceptions of aquaculture in Minnesota as part of MNSG’s Food-Fish Market Study project.

The project, funded by the National Sea Grant Office (NSGO) and National Oceanic and Atmospheric Administration (NOAA), is a collaboration between MNSG and faculty from the University of Minnesota Department of Applied Economics. A goal of the project is to better inform fish producers and fish consumers about the ongoing and potential for food-fish aquaculture in Minnesota. The participant responses may also have indirectly answered my question about the future of a fish barn at the fair.

What is aquaculture and why do we care?

NOAA defines aquaculture as the breeding, rearing, and harvesting of fish, shellfish, algae, and other organisms in all types of water environments. Aquaculture includes growing fish for human consumption.

Minnesota's food-fish aquaculture industry is small. Food-fish includes fish and seafood such as shrimp and other forms of shellfish sold for human consumption.

In the United States there is a growing interest in producing farmed fish as an affordable and delicious protein source. In 2020, only about 0.7% of worldwide seafood produced by aquaculture was grown in North America (FAO 2022). The United States Department of Agriculture (USDA) and NOAA seek to increase the amount of seafood produced through aquaculture in the U.S. Minnesota’s food-fish aquaculture industry is small. Food-fish includes fish and seafood such as shrimp and other forms of shellfish sold for human consumption.

When our project team talked with emerging and potential aquaculture producers they told us that two major barriers to aquaculture industry growth were:

- A lack of information about consumer demand for farmed fish

- A lack of clarity about consumers’ willingness to pay for locally produced fish

Potential growers also told us they were interested in:

- Which fish-growing production systems and species might be best suited for profitability in Minnesota, but said they found information was largely anecdotal or did not exist.

Our consumer food-fish survey was designed, in part, to answer some of these questions.

What did we learn from our survey?

Our project team spent two half-days at the August 2022 Minnesota State Fair and recruited 182 fairgoers to take our tablet-based consumer food-fish survey. As part of the survey, each survey participant was offered a taste of locally farmed and smoked Yellow Perch. We used this survey as a test of participants’ understanding of our questions and to assess whether the length of the survey was appropriate. We’ll use the results of this survey to inform the design of a second survey we plan to distribute statewide in summer 2023.

Highlights from our survey results

A few highlights were selected from the overall consumer survey results that were analyzed and summarized by Professor Hikaru Peterson from the University of Minnesota Department of Applied Economics, and are presented below.

Demographics

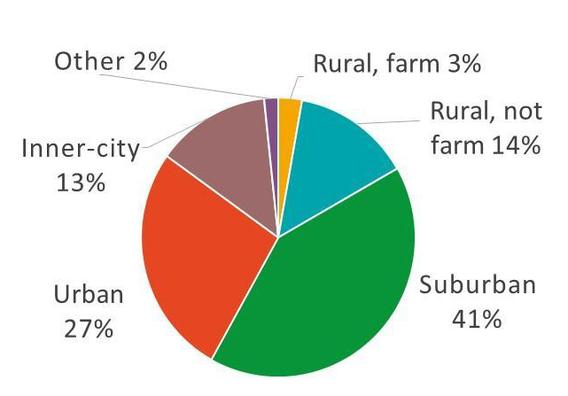

Approximately 80% of survey participants were from an urban or suburban area (Fig. 1) with the majority living in the Twin Cities metropolitan area. Gender of survey participants was highest for females at 53%, followed by males at 46%, with one percent of respondents who preferred not to answer. Survey participants were between the ages of 18-74 and participants were relatively evenly distributed across age groups.

- 83% of participants identified as White.

- 6% of participants preferred not to answer.

- 5% of participants identified as Asian.

- 2% of participants identified as Black.

- 2% of participants identified as Hispanic.

- 1% of participants identified as American Indian.

Seafood Preferences

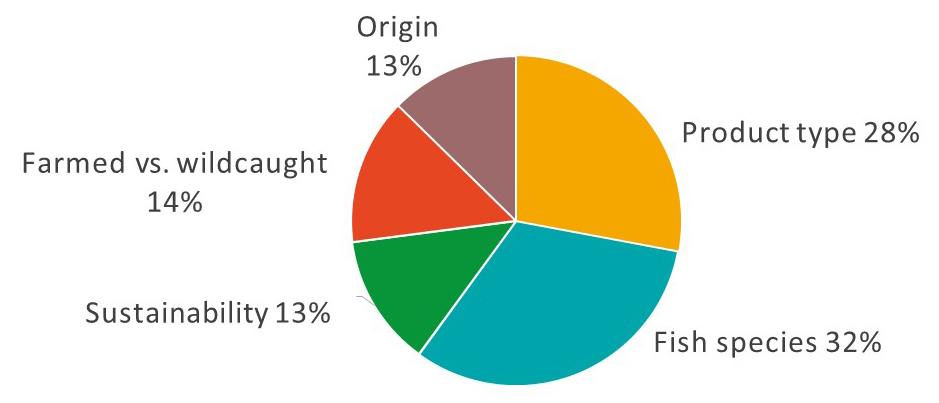

Survey participants were asked what attributes were most important to them when purchasing seafood.

- The two most important attributes were product type (e.g., fresh, frozen, raw) and fish species (Fig. 2).

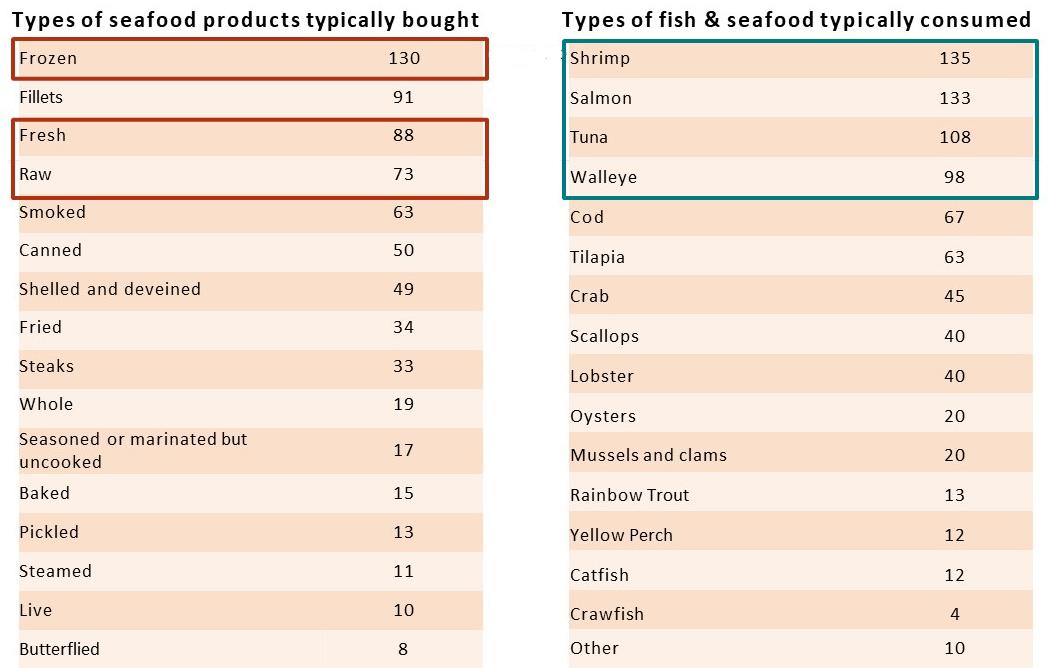

- The type of seafood product participants purchased most frequently was frozen, followed by fresh and then raw (Fig 3).

The most highly ranked cut or type of processing was fillet, followed by smoked, canned, and whole fish (Fig. 3). The most frequently consumed seafood type was shrimp, followed by salmon, tuna and Walleye (Fig. 3).

Willingness to Pay (WTP)

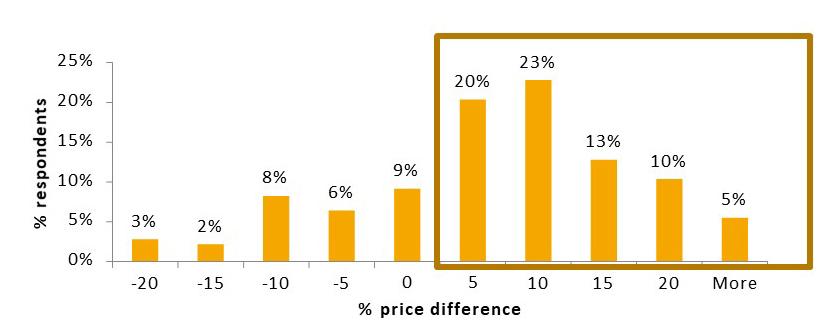

When survey participants were asked if they were willing to pay more for Minnesota farmed fish than for Minnesota wild-caught fish, or vice versa the responses were approximately equal. However, after tasting a sample of farm reared fish, the survey participants I observed said that they were willing to pay more for farmed fish. When survey participants were asked if they were willing to pay more for Minnesota farm-reared Tilapia than Minnesota farm-reared Walleye, 70% indicated they were willing to pay an additional 5% to more than 20% for the farm-raised Walleye (Fig. 4).

Understanding of Aquaculture

When survey participants were asked about their familiarity with aquaculture,

- 32% indicated they had a good understanding of aquaculture

- 18% responded that they had no understanding of aquaculture

- 50% indicated that they had heard the term but were not confident of what it meant.

When asked if they had ever tasted Minnesota farmed fish before the survey,

- 22% said yes

- 32% said no

- 46% were not sure

We asked survey respondents to write down three words they associated with Minnesota farmed fish. The project team used the results to create a word cloud (image above) which is a simple visual representation of information. The most frequently used words appear larger or bolder when compared with the other words around them (Fig. 5). The words “fresh” and “local” stood out, followed by “sustainable” and “Walleye.” After participants tasted the farm-raised smoked Yellow Perch, they added the words “tasty” and “smoked” to the word cloud.

Takeaways

“The main takeaways from my perspective were that so many people had little understanding of what aquaculture is, and more than half of those surveyed expressed no negative views toward aquaculture,” said Hikaru Peterson, professor of Applied Economics. Other important findings were that most survey participants seemed willing to pay more for locally grown fish and favored farmed Walleye over farmed Tilapia, which in Minnesota is not a surprise given that the state fish is the Walleye. In most cases, after tasting the farm-reared smoked Yellow Perch survey participants felt more favorable to Minnesota-raised aquaculture products.

Project Team

We give a grateful shout-out to our project collaborators University of Minnesota Professor Hikaru Peterson from the UMN Department of Applied Economics in the College of Food, Agricultural and Natural Resources Sciences and her graduate student Kristi Getschel.

What's next?

Knowing what consumers are willing to pay, and what it costs farmers to produce their products will determine if aquaculture in Minnesota can be profitable, and what species and aquaculture systems might be most economically successful. This information is important for industry growth. Credible information on supply, demand and profit will also be useful for banks, lending agencies and venture capitalists looking to invest in aquaculture.

Kristi Getschel, a master’s degree candidate working on the project with Professor Peterson said, “After the 2023 statewide consumer survey is distributed, my plans are to meet with and interview Minnesota aquaculture producers later in summer or early fall of 2023 to get an estimate of what it costs to grow seafood for the marketplace.”

Closing thoughts

So, will we see a fish barn at the state fair in the near future? There seems to be enthusiasm by Minnesota's aquaculture industry for expanding the food-fish component of aquaculture in Minnesota, but it’s a bit too soon to start construction. MNSG will continue to share results of our food-fish market study that we hope will tell us if food-fish aquaculture is profitable in Minnesota, and if so … maybe that barn at the state fair will become a reality!

If you want to know more about what Minnesota Sea Grant is doing in fisheries and aquaculture, I encourage you to check out MNSG's Fisheries and Aquaculture program. If you have questions or want more information about MNSG's Aquaculture Market Study, please contact me, Don Schreiner.